Schaeffler off to good start in 2025

2025-05-07 | Herzogenaurach

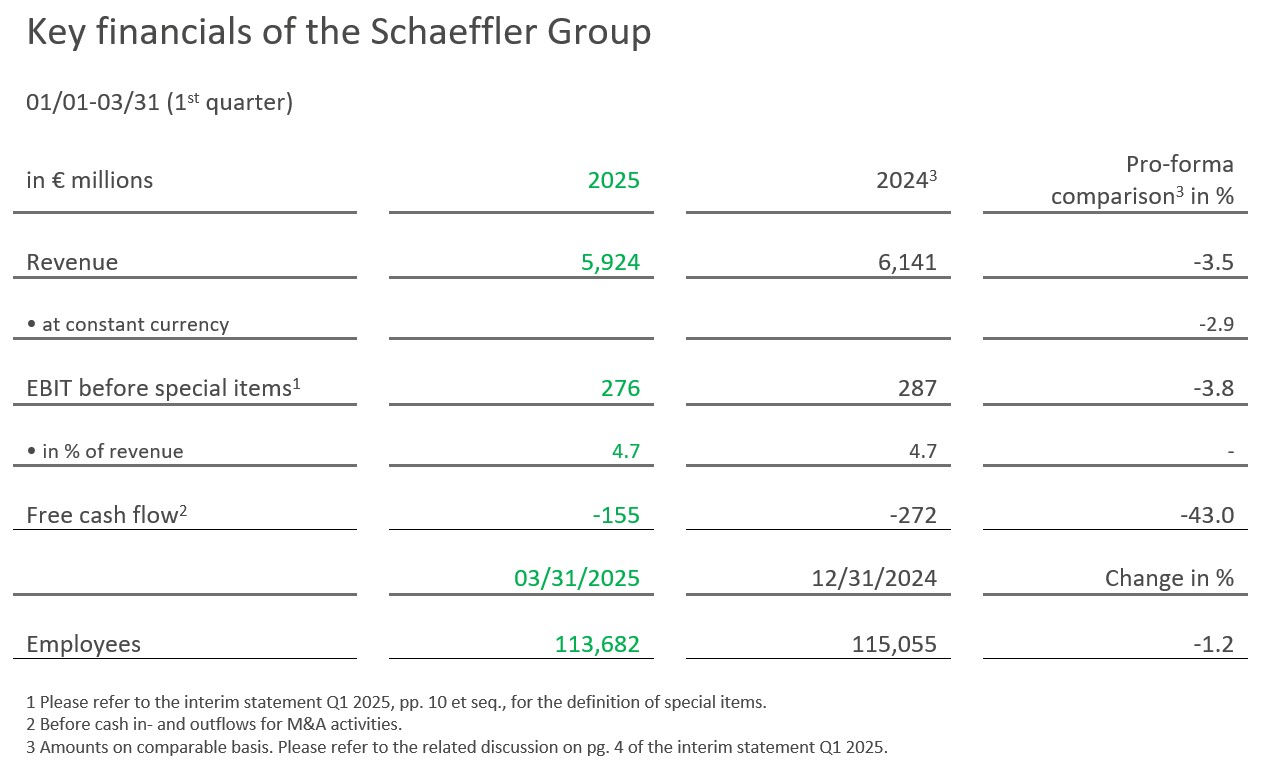

- Revenue of 5.9 billion euros slightly below prior year (pro-forma prior year Q1 2024: 6.1 billion euros), down 2.9 percent at constant currency

- EBIT margin before special items of 4.7 percent at prior year level (pro-forma prior year Q1 2024: 4.7 percent)

- E-Mobility with solid revenue growth, double-digit EBIT margins before special items at Powertrain & Chassis, Vehicle Lifetime Solutions, and Bearings & Industrial Solutions

- Free cash flow before cash in- and outflows for M&A activities at -155 million euros (pro-forma prior year Q1 2024: -272 million euros)

- Full-year guidance for 2025 confirmed

Schaeffler AG published its results for the first quarter of 2025 today. Revenue for the first three months of the year was 5,924 million euros; based on pro-forma amounts and at constant currency, revenue was 2.9 percent below prior year (pro-forma prior year: 6,141 million euros).

Group-level revenue declined by 5.3 percent in the Europe region in the first quarter, compared on a pro-forma basis and at constant currency. The Americas and Greater China regions reported constant-currency revenue declines of 0.9 percent and 5.4 percent, respectively, compared on a pro-forma basis. In contrast, Asia/Pacific region revenue grew by 5.7 percent at constant currency in the first quarter of the year, compared on a pro-forma basis.

The Schaeffler Group generated 276 million euros in EBIT before special items in the first three months (pro-forma prior year: 287 million euros). The EBIT margin before special items of 4.7 percent was flat with prior year, compared on a pro-forma basis.

Klaus Rosenfeld, CEO of Schaeffler AG, stated: “The first quarter of 2025 is the first time the Schaeffler Group reports its results as a combined company with four product-oriented divisions. We are off to a good start in 2025 with the results of the first quarter. The environment we are operating in remains risky and unclear. Our broad positioning gives us the necessary resilience and helps us operate successfully and achieve our goals even in this environment.”

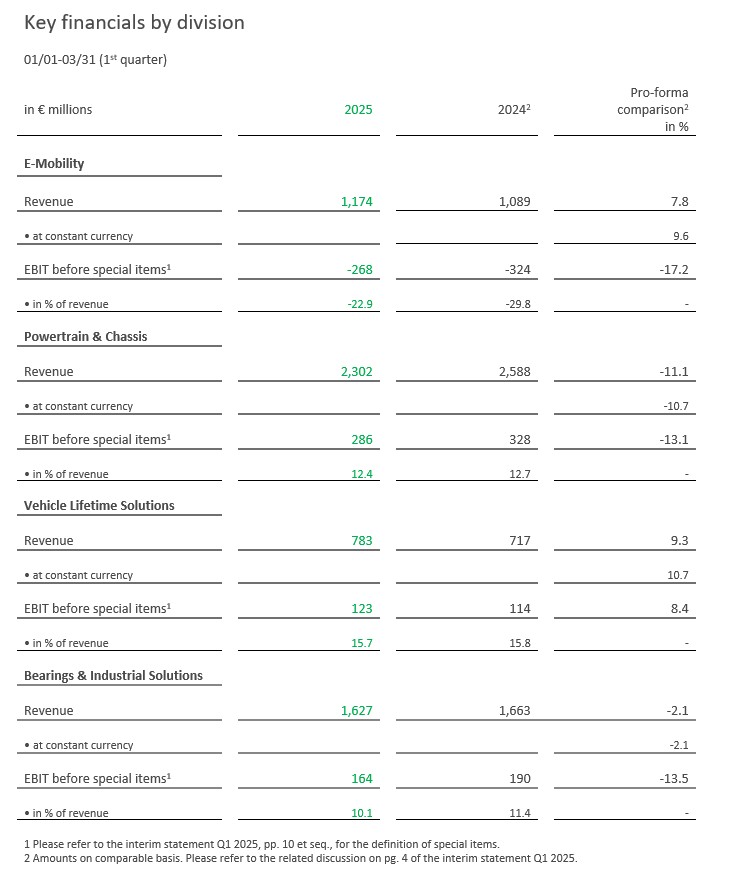

E-Mobility – Revenue increased considerably, order intake 3.0 billion euros

The E-Mobility division generated 1,174 million euros in revenue in the first quarter, a constant-currency increase of 9.6 percent compared on a pro-forma basis (pro-forma prior year: 1,089 million euros). The increase was mainly due to product ramp-ups in the Europe, Americas, and Asia/Pacific regions. The division’s first-quarter order intake amounted to 3.0 billion euros.

EBIT before special items of -268 million euros was generated during the reporting period (pro-forma prior year: -324 million euros), representing an EBIT margin before special items of -22.9 percent for the first quarter (pro-forma prior year: -29.8 percent). The improvement in the EBIT margin before special items, compared on a pro-forma basis, was primarily the result of a favorable impact of volumes.

Powertrain & Chassis – EBIT margin before special items 12.4 percent

Compared on a pro-forma basis, Powertrain & Chassis division revenue declined by 10.7 percent at constant currency in the first quarter of 2025, largely due to a market-driven decrease in volumes in the Europe region. The division generated total revenue of 2,302 million euros (pro-forma prior year: 2,588 million euros) and reported an order intake of 2.8 billion euros during the reporting period.

The Powertrain & Chassis division generated EBIT before special items of 286 million euros in the first quarter (pro-forma prior year: 328 million euros). The EBIT margin before special items amounted to 12.4 percent (pro-forma prior year: 12.7 percent) and is primarily marked by the impact of volumes.

Vehicle Lifetime Solutions – EBIT margin before special items 15.7 percent

In the Vehicle Lifetime Solutions division, revenue for the reporting period rose by 10.7 percent, compared on a pro-forma basis and at constant currency, to 783 million euros (prior year: 717 million euros), largely due to higher volumes.

123 million euros in EBIT before special items was generated in the first quarter (pro-forma prior year: 114 million euros). The EBIT margin before special items of 15.7 percent was flat with prior year when compared on a pro-forma basis (pro-forma prior year: 15.8 percent), with foreign exchange losses offset by the favorable impact of volumes and sales prices.

Bearings & Industrial Solutions – EBIT margin before special items 10.1 percent

Compared on a pro-forma basis, Bearings & Industrial Solutions division revenue declined by 2.1 percent at constant currency in the first quarter of 2025, largely due to a market-driven decrease in volumes in the Europe region. The division generated total revenue of 1,627 million euros (pro-forma prior year: 1,663 million euros).

The division generated EBIT before special items of 164 million euros (pro-forma prior year: 190 million euros). The EBIT margin before special items amounted to 10.1 percent (pro-forma prior year: 11.4 percent). The decline compared to the prior year was mainly due to a market-driven decrease in volumes in the Europe region.

Free cash flow – Negative due to seasonal factors but better than prior year

Free cash flow before cash in- and outflows for M&A activities for the first quarter was -155 million euros (pro-forma prior year: -272 million euros) due to seasonal factors. Capital expenditures on property, plant and equipment and intangible assets (capex) were 250 million euros in the first quarter of 2025 (pro-forma prior year: 317 million euros).

Net income attributable to shareholders of the parent company amounted to 83 million euros. Earnings per common share were 0.09 euros.

The Schaeffler Group’s net financial debt amounted to 5,013 million euros as at March 31, 2025. The net financial debt to EBITDA ratio before special items on a pro-forma basis was 2.2 as at March 31, 2025. The ratio of net financial debt to shareholders’ equity (gearing ratio) amounted to 122.6 percent.

Claus Bauer, CFO of Schaeffler AG, said: “Schaeffler AG succeeded in maintaining its earnings quality at the prior year level in the first quarter of 2025, despite the continuing transformation and challenging market conditions. Free cash flow is influenced by seasonal factors but is considerably better than in the prior year. We will continue to carefully manage our financial resources. With 2025 off to a good start, our main priority for the coming quarters will now be on playing to our strengths and consistently continuing our alignment toward the future, despite the dynamic trade and geopolitical situation.”

The company had a workforce of 113,682 employees worldwide as at March 31, 2025.

Outlook confirmed – Trade conflicts increase lack of planning reliability

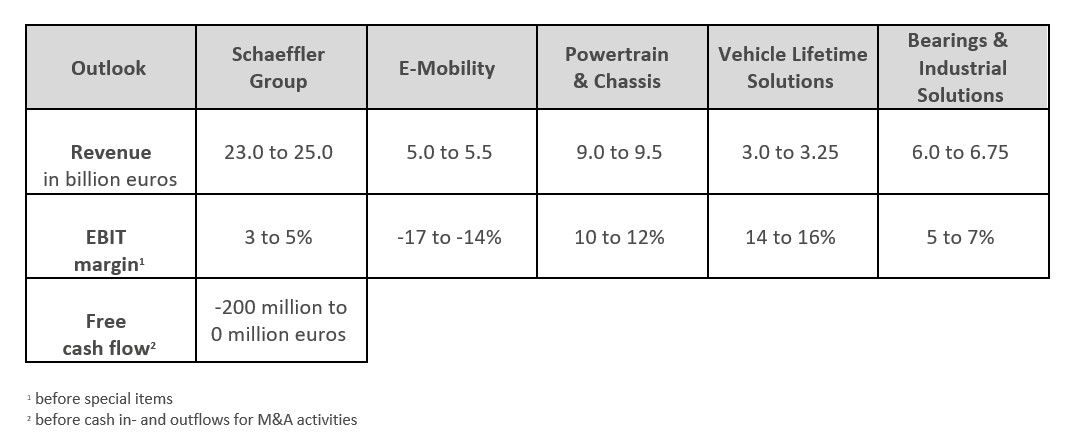

At its meeting on April 28, 2025, the Board of Managing Directors of Schaeffler AG confirmed the outlook issued on February 18, 2025.

Schaeffler is currently reviewing and implementing measures to mitigate the impact of the current tariff regulations. Due to the dynamic situation, a conclusive quantitative assessment is only possible to a limited extent at this time.

Based on this, the Schaeffler Group continues to anticipate 23 to 25 billion euros in revenue in 2025. In addition, the company expects to generate an EBIT margin before special items of 3 to 5 percent in 2025. The Schaeffler Group continues to anticipate free cash flow before cash in- and outflows for M&A activities of -200 to 0 million euros for 2025.

“We are maintaining our outlook despite the challenging environment, conscious of the fact that the current trade policy disputes are increasing the lack of planning reliability,” Klaus Rosenfeld said.

1 The pro-forma comparative amounts are based on the assumption that Vitesco was acquired as at January 1, 2024, and is therefore included in full in the prior year amounts. See pg. 4 of the interim statement Q1 2025 for further information. The above pro-forma amounts 2024 and the related information were not subject to the 2024 financial statement audit.

You can find press photos of the Board of Managing Directors here: www.schaeffler.com/en/executive-board

Forward-looking statements and projections

Certain statements in this press release are forward-looking statements. By their nature, forward-looking statements involve a number of risks, uncertainties and assumptions that could cause actual results or events to differ materially from those expressed or implied by the forward-looking statements. These risks, uncertainties and assumptions could adversely affect the outcome and financial consequences of the plans and events described herein. No one undertakes any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. You should not place any undue reliance on forward-looking statements which speak only as of the date of this press release. Statements contained in this press release regarding past trends or events should not be taken as representation that such trends or events will continue in the future. The cautionary statements set out above should be considered in connection with any subsequent written or oral forward-looking statements that Schaeffler, or persons acting on its behalf, may issue.

Publisher: Schaeffler AG

Country: Germany

Press releases

Package (Press release + media)